Pinnacle’s Investment Process

Top-Down Research

To define the investment universe, Pinnacle’s investment process initially examines how the world is changing and where it is headed.

Ideation

Identify Disruptive Innovation

Sizing The Opportunity

Define The Potential Universe

Bottom-Up Research

To refine the investment opportunity, Pinnacle’s bottom-up analysis evaluates potential investments based on our defined key metrics.

Stock Selection And Valuation

Select Portfolio Companies

Portfolio And Risk Management

Monitor Conviction & Market Volatility

Top-Down: Ideation

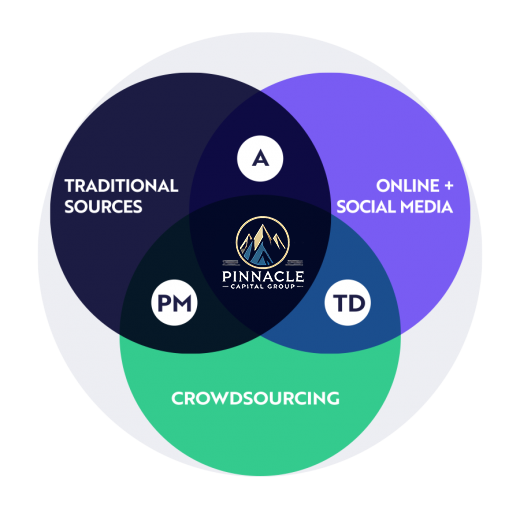

Pinnacle’s research and investment team initially examines from the top-down how the world is changing and where it is headed. To understand quickly changing innovation themes, Pinnacle employs an open research ecosystem to gather information, both helping to define and refine its internal research process. Inputs include theme developers who are thought leaders in their fields, social media interactions, and crowd-sourced insights as people respond to Pinnacle’s public research.

Pinnacle’s Open Research Ecosystem

-

Analysts

-

Theme Developers

-

Portfolio Managers

Research Model Example

Top-Down: Sizing The Opportunity

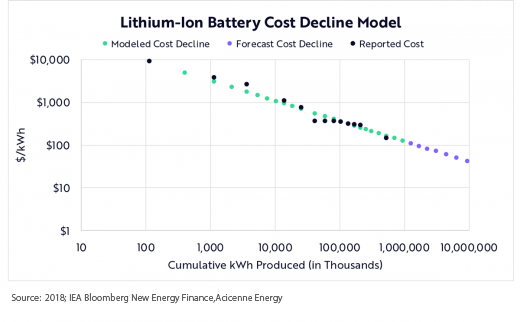

As a result of extensive and iterative research steps, Pinnacle anticipates and quantifies multi-year value-chain transformations and market opportunities. Pinnacle models cost-curves and calculates elasticity of demand to identify entry points for technology enabled disruption. Through this process, specific companies percolate to the top as best positioned to benefit, at which point we begin our bottom-up process.

Bottom-Up: Stock Selection And Valuation

Pinnacle’s bottom-up analysis begins with a distilled group of potential investments, not a benchmark. Pinnacle evaluates potential investments based on key metrics to quantify the companies in context of the opportunity. This includes building out a valuation and revenue model for each company in the portfolio over the next five years. These models incorporate the company’s unit volume growth, cost declines, market adoption and penetration, share count growth, and future multiples. Finally, as the CIO and Portfolio Manager, Cathie Wood has the final accountability for the selection of investments and approval for all investment decisions.

-

Investment Briefs

-

Company Scores

-

Five Year Valuation Models

Portfolio Tracker

Bottom-Up: Portfolio and Risk Management

Pinnacle monitors the underlying investment thesis of every company during weekly portfolio and research meetings. Generally, Pinnacle will trim or add to positions to, among other things: (i) take advantage of opportunities created by short-term negative market actions or market sentiment; (ii) provide liquidity to invest in companies in which Pinnacle has relatively more confidence; or (iii) fund names that Pinnacle believes offer relatively more market opportunity relative to current price. Pinnacle may sell a company if our investment thesis has changed, Pinnacle’s metrics don’t support a certain position size, or we believe a company is no longer on the leading edge of innovation.